Tecknuovo ranked on the Sunday Times 100 Fastest-Growing Companies list

This list recognises the fastest-growing private companies in the United Kingdom. Listed companies must demonstrate consistent growth, create jobs, and, sustain profitability.

The insurance industry, hundreds of years old and running largely on legacy solutions, is facing a huge opportunity to upgrade its operations by embracing modern technologies.

Our customer is a global insurer with a considerable history in the industry. Their underwriters were assigning insurance policies on a manual basis, allocating inaccurate policy premiums too often and bleeding both time and budget. Looking to sharpen their underwriters’ accuracy and cut costs, our customer saw an opportunity to tap into their data. They chose to pursue this path with Palantir, but were lacking the rare and advanced skills in the platforms and languages needed to tap value from Palantir’s next-generation data analytics capabilities. With this pressing challenge, the insurer turned to Tecknuovo for help.

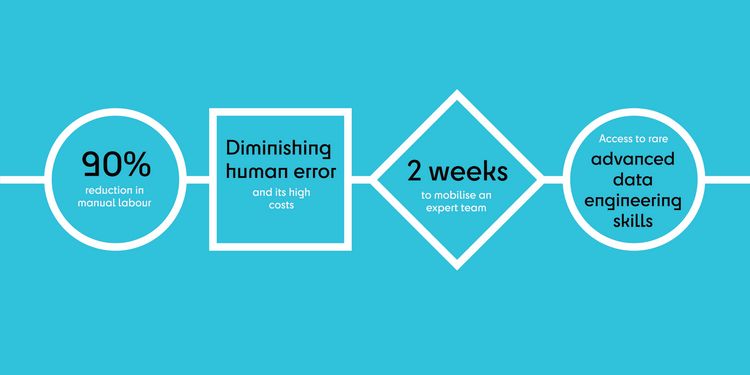

Drawing on our wide network of talented data professionals, we mobilised a small, efficient team of Palantir Foundry experts in under two weeks. Working with our customer’s stakeholders to understand their requirements and future vision, we proposed to build a bespoke data analytics product that would break both the company and the industry’s mould of how underwriters assign policy premiums.

Our teams built a powerful data analytics product that diminishes the possibility of human error and the heavy cost it incurs for our customer. The data engineering skills needed to build this type of product are critical for disrupting the industry, and also extremely rare.

The product takes historical data from our customer’s policy assignments, and distills it into an accessible user interface (UI) that displays:

The product seamlessly delivers these insights through a series of automated processes. It extracts data on past cases from our customer’s Oracle systems to Palantir, which gets denormalised and generates a data pipeline in PySpark. It then gets sent to be modelled using our engineers’ code, before we do final manipulations and add objects on top of the datasets that create the end-product UI.

The product provides huge benefits for users and the organisation alike. It means that only 10% of cases need to be reviewed by the team in the UI, because it automatically analyses and assigns the other 90% in the background. This doesn’t only remove a vast amount of manual labour for our customer’s underwriters, but also lets them assign policies with unprecedented accuracy.

Using next-generation data analytics in this way is a groundbreaking move in the insurance sector, and could catapult our customer to pole position in the industry’s race to modernise.

This list recognises the fastest-growing private companies in the United Kingdom. Listed companies must demonstrate consistent growth, create jobs, and, sustain profitability.

When goods are imported into the EU, traders must declare them prior to arrival at their port of entry so that their security risk profiles can be determined and assessed. The Import Control System (ICS) is a Europe-wide platform to enable the online processing of safety and security declarations for these goods and automates procedures so traders only have to submit information about goods only once.

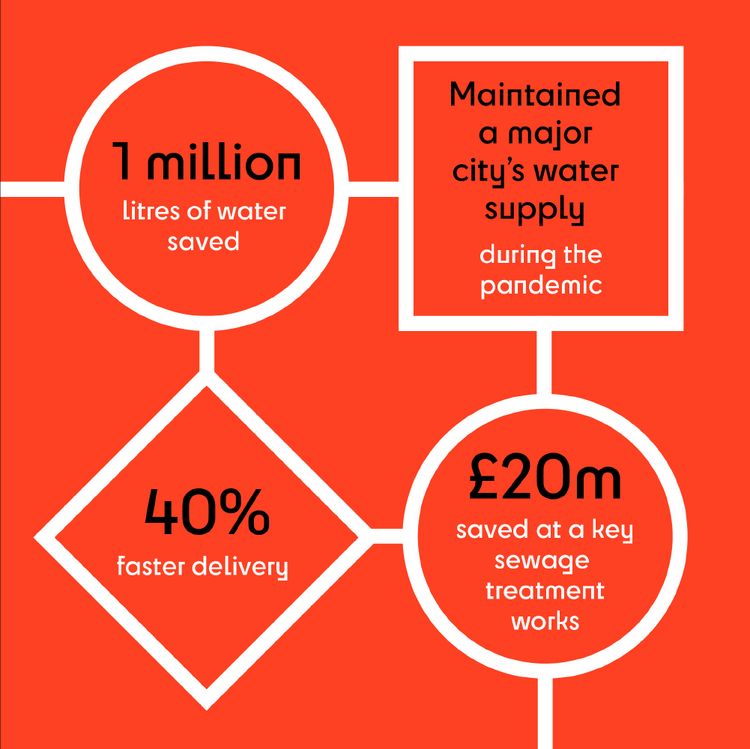

Our customer is one of the UK’s biggest utilities companies. Their Data Factory data integration platform was generating intelligence and forecasts through data mining, exploration, analysis and interpretation to detect blockages and leaks in their physical infrastructure.